Explore the Benefits of a Ready-Made Swiss E-Money Company for Sale

In today's rapidly evolving financial landscape, the demand for e-money services has surged. Investors and entrepreneurs seek innovative solutions that integrate technology with financial services, and Switzerland stands out as a premier destination for such ventures. This article delves into the intricacies of a ready-made Swiss e-money company for sale, examining its features, advantages, and the steps involved in acquiring one. Whether you're an established entity in the financial sector or a newcomer aiming to make your mark, understanding this opportunity is crucial.

Understanding Swiss E-Money Companies

Switzerland, renowned for its stable economy and robust banking infrastructure, has also become a hotspot for e-money institutions. These companies facilitate electronic payments and transactions, offering services such as:

- Online Banking Solutions

- Payment Processing Services

- Digital Wallets

- Crypto Wallet Solutions

With a strong regulatory framework and a reputation for security, Swiss e-money companies are well-positioned to capitalize on the increasing global demand for digital financial solutions.

The Advantages of a Ready-Made E-Money Company

Opting for a ready-made Swiss e-money company for sale comes with numerous benefits:

1. Quick Market Entry

Starting a new financial venture from scratch can be a lengthy and complex process. By acquiring a ready-made company, businesses can bypass the regulatory hurdles and lengthy setup timeline typically involved in launching new e-money services, enabling a swift entry into the market.

2. Established Brand and Clientele

A ready-made company often comes with an existing brand identity and a customer base. This advantage facilitates immediate revenue generation and market presence, allowing new owners to focus on growth strategies rather than brand building.

3. Regulatory Compliance

Swiss e-money companies operate under the supervision of the Federal Financial Market Supervisory Authority (FINMA). Acquiring an already established entity means navigating the regulatory landscape has already been handled, mitigating the complexities involved in obtaining the necessary licenses and approvals.

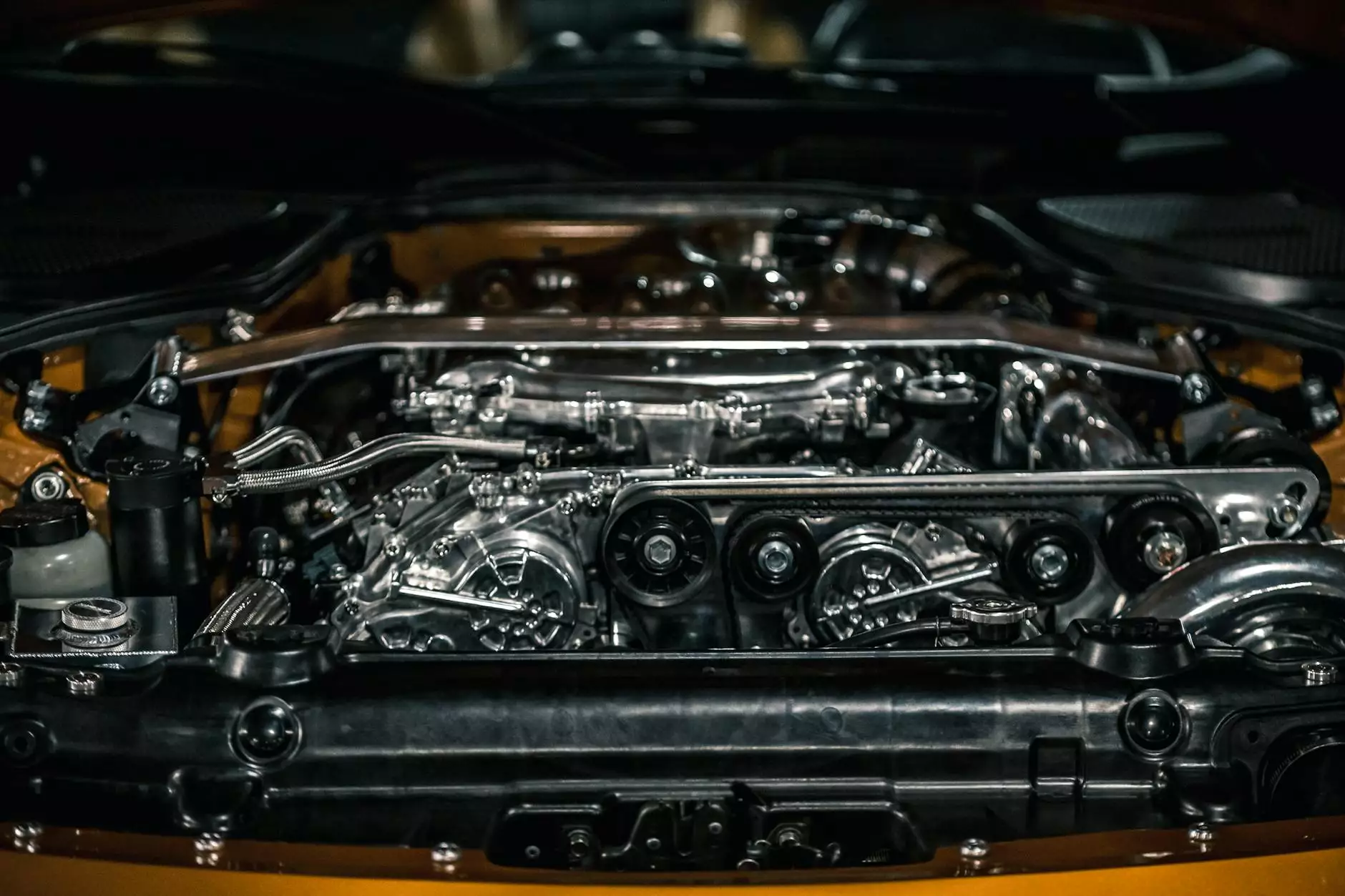

4. Advanced Infrastructure and Technology

Many ready-made e-money companies come equipped with sophisticated technology platforms that enhance operational efficiency. By leveraging existing infrastructure, new owners can quickly implement their business strategies.

Key Features of a Swiss E-Money Company

When considering a ready-made Swiss e-money company for sale, it's crucial to evaluate several key features:

1. Licensing and Compliance

Ensure that the company holds the necessary licenses to operate as an electronic money institution in Switzerland. Compliance with local regulations is paramount for long-term success.

2. Financial Health

Review the company’s financial statements, including assets, liabilities, and profitability. A thorough financial analysis will provide insights into the company’s operational efficiency and growth potential.

3. Customer Base and Market Position

Assess the existing customer base and the company's position within the market. An established clientele can significantly reduce acquisition risks and enhance profitability.

4. Technology Stack

The underlying technology is a vital consideration. Evaluate the capabilities of the payment processing software, security measures, and scalability of the platform to meet future demands.

How to Acquire a Ready-Made Swiss E-Money Company

The process of acquiring a ready-made e-money company in Switzerland involves several critical steps:

1. Research and Identify Opportunities

Utilize platforms and resources that specialize in the sale of financial institutions. Thoroughly research available options that meet your investment criteria.

2. Due Diligence

Conduct comprehensive due diligence to evaluate the company's operational, financial, and legal status. This process should involve:

- Reviewing corporate documents

- Analyzing financial records

- Conducting interviews with key personnel

3. Valuation

Determine a fair market value for the company based on its financial performance, market position, and future potential. Engaging experienced financial advisors can be beneficial at this stage.

4. Negotiation and Purchase Agreement

Once a suitable company is identified, negotiate the terms of the acquisition. This includes the sale price, payment terms, and any contingencies. Draft a legally binding purchase agreement outlining all terms.

5. Transition and Integration

After the acquisition is finalized, focus on the successful transition and integration of the company into your existing operations. Develop a strategic plan to retain customers and enhance service offerings.

The Future of E-Money Companies in Switzerland

The future of e-money in Switzerland is bright. As consumers increasingly shift towards digital payments and as e-commerce continues to flourish, the demand for innovative financial solutions will only grow. This presents a fantastic opportunity for both new and existing players to expand their services.

Technological Advancements

Ongoing technological advancements in areas like blockchain, artificial intelligence, and mobile payments will reshape the industry landscape. Companies that adapt and integrate these technologies will likely experience substantial growth.

Regulatory Evolution

Switzerland's regulatory environment is evolving. Continuous engagement with regulatory bodies will be crucial for e-money companies to ensure compliance and foster public trust.

Increased Competition

As the market matures, competition among e-money service providers is expected to intensify. Companies that offer unique features, exceptional customer service, and innovative solutions will have a competitive advantage.

Conclusion

In conclusion, the acquisition of a ready-made Swiss e-money company for sale offers a myriad of benefits, from expedited market entry to established infrastructure and customer bases. For entrepreneurs looking to make an impact in the financial sector, this opportunity represents a strategic pathway to harnessing the burgeoning digital finance market. By entering this space with a well-prepared acquisition strategy and a clear vision for future growth, businesses can thrive in one of the most stable and progressive financial environments in the world.

For more details and opportunities for acquiring a Swiss e-money company, visit eli-swiss.com.